Solutions

Platform of Internet Finance

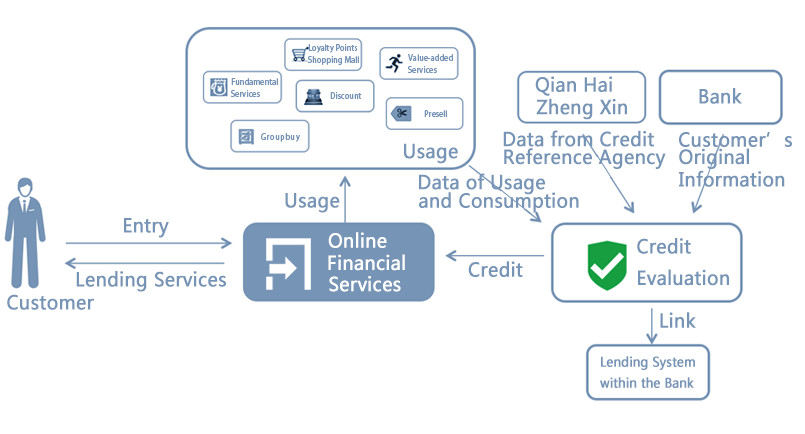

- Developing and operating the platform of internet finance, achieving online selling and lending;

- Promoting financial products to regular customers and new customers through direct and indirect banking, increasing customer base and revenues for the bank;

- High compatibility between P2P lending platform and non-financial services provider, linking online lending with traditional lending model, granting loans online quickly and easily;

- Collecting and analyzing the data of other financial services and credit scoring, improving customized services;

Direct Banking

Direct banking is a new operation model in the age of internet. The bank no longer has to set up brick and mortar branches or issue tangible bank cards, as customers have access to financial products and services via computers, emails, mobile phones and telephones. Since the operational cost has been saved, the bank is able to lower the bank charge and provide a more competitive interest rate. The core values of direct banking are to cut down operational cost, and give more to the customers.

Online Lending

Apart from the limited information collected by traditional financial services, F-Road helps the bank to gather more data of individual customers and small and micro enterprises by tracking their consumption pattern, social networking and daily activities. F-Road also includes external data provided by credit reference agency, extending the bank's knowledge about the customers and improving the credit evaluation system. The new online lending system is connected to the traditional lending system in the bank, offering credit actively and granting loans online.

沪公网安备 31011502002215号

沪公网安备 31011502002215号